Germany - New income thresholds

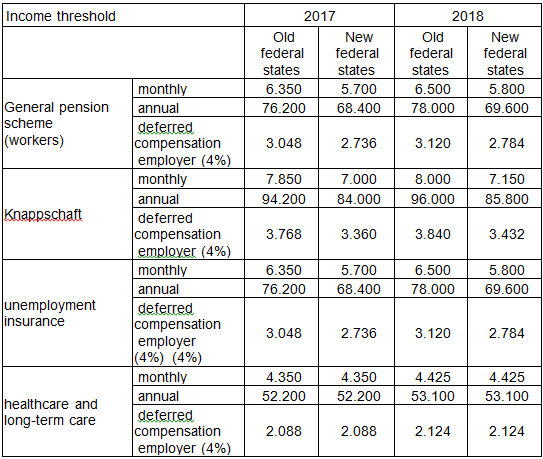

Each year, in January, the new income thresholds for the old and new federal states are published. They serve as a limitation for the social insurance contribution which has to be paid to the pension fund.

If a monthly or annual gross salary is exceeded, only the social contribution as a percentage of the maximum amount (=income threshold) is calculated. The remaining difference is exempt from the insurance contribution. In regards to the pension scheme, the employee has a claim for deferred compensation against the employer according to Para. 1a Abs.1, Abs.3 Company Pension Act (“BetrAVG”) in conjunction with Para. 10a Income Tax Act (“EStG”). This means that the employee waives a certain part of his remuneration and obtains an occupational pension scheme in return. Thus, the employee can ¬-also make use of the Riester subsidy through occupational pension schemes. The employer is obligated to contribute up to 4% of the annual income threshold from the employee’s gross salary on their company pension scheme.

Income thresholds 2018:

(All references in EUR)

As one can see from the table above, the annual income thresholds for 2018 have increased to EUR 78.000 and EUR 69.600 for old and new federal states respectively. On the basis of these references, the 4 % claim for deferred compensation is EUR 3.120 (old federal states) and EUR 2.784 (new federal states).

This type of Riester funding can be carried out by pension funds or direct insurance companies. The employee remains the contractual partner of the pension scheme contract. The employer solely retains the respective amount from the gross salary and forwards it directly to the pension institution.