Update: EU Directive on platform work

The proposal: process and status, objectives

The legislative history of the draft Platform Work Directive (‘the Draft Directive’) is quite bumpy, to say the least. The interaction between the institutions (EU Commission, EU Parliament and EU Council) on the legislative proposals since 2021 has led to surprising stalemate situations, particularly at the end of 2023, due to political circumstances in certain Member States.

Under the Belgian Council Presidency, negotiations have taken place since January 2024, which have now resulted in a compromise text of the Draft Directive, accepted by the national Ministers of Labour. The next step is to have the EU Council formally approve the Draft, have it promulgated and published in the Official Journal. Once published, Member States will have two years to transpose its provisions into national law.

The aim of the Draft Directive is to improve the working conditions of platform workers, increase the protection of personal data and at the same time increase the transparency of platform work. In most cases, platform workers are currently not classified as employees but as self-employed and therefore do not enjoy any protection under labour law. The Draft Directive therefore primarily serves to differentiate between self-employment and employment. In its final now approved version, the Draft Directive is considered to be somewhat of a watered-down version compared to earlier drafts (as will be outlined below).

In terms of societal impact, it is estimated that there are currently about 5.5 million platform workers in the EU, that they are mainly highly educated, and that the vast majority performs duties as platform worker in a secondary or ancillary job.

In this Newsletter we will focus on the first (most mediatized) part of the Draft Directive, on the employment status of the platform workers.

What is platform work?

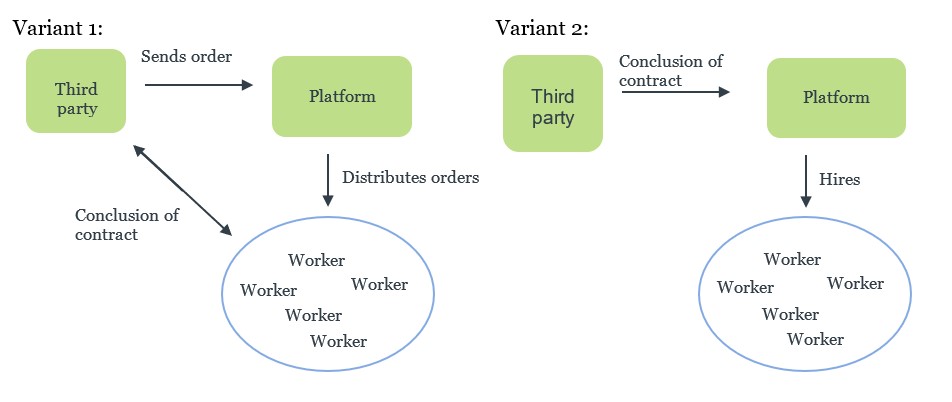

Platform work, also known as "crowd working", involves a digital work platform distributing work assignments to individual external workers, who then must complete them on a computer or at a specific location. These workers are either self-employed or employed by the platform.

What is considered as a platform?

Under the Draft Directive, a platform is understood to be a service which is provided, at least in part, at a distance through electronic means, such as a website or a mobile application, at the request of a recipient of the service, which involves, as a necessary and essential component, the organisation of work performed by individuals in return for payment (irrespective of whether that work is performed online or in a certain location) and which involves the use of automated monitoring or decision-making systems.

Classic examples of such platforms are: Lieferando, Uber, Deliveroo, Wolt oder Fiverr.

To determine whether a platform exists, it will be relevant whether it can control the service in any way. Therefore, mere job placement portals, e.g., Stepstone or Monster, do not currently constitute platforms. Considering the wide definition of a platform, it cannot be excluded that more ‘traditional companies’ in the services industries, which meet the requirements of the definition above for part of their business activities (e.g., software development, IT maintenance/repair and the like) would also fall within the scope of the Draft Directive.

Also, providers whose main purpose is to sell goods or resell goods and services are also not covered. This means that Amazon, Airbnb and similar providers in particular do not fall within the Draft Directive's scope of application.

Deferral to the Member States for status determination and the presumption rule

Since the Draft Directive aims at protecting platform workers and their working conditions, the determination of the proper status they hold (employee or self-employed) is the key element of the regulatory framework.

Contrary to earlier (not accepted drafts), the Draft Directive now leaves it to the Member States to introduce/have appropriate and effective procedures in place to verify and ensure the correct determination of the employment status of persons performing platform work, with a view to ascertaining the existence of an employment relationship as defined by the law, collective agreements or practice in force in the Member States. In doing so, the Member States shall apply the presumption rule, according to which a platform worker is presumed to be an employee of the platform if the platform exercises control and direction over the work performance.

Instead of setting a list of criteria which would mandatorily indicate whether the presumption prevails (which the previous draft contained), the compromise that has now been reached deviates from this line and allows the Member States to draw up their own catalogue of criteria, based on a few general principles, as follows: the contractual relationship between a platform and a person performing platform work through that platform shall be legally presumed to be an employment relationship when facts indicating control and direction, according to national law, collective agreements or practice in force in the Member States are found, guided primarily by the facts relating to the actual performance of work, including the use of automated monitoring or decision-making systems in the organisation of platform work, irrespective of how the relationship is classified in any contractual arrangement that may have been agreed between the parties involved.

If the presumption rule applies (i.e., cannot be successfully rebutted by the platform), the platform worker is considered to be an employee, with the consequence that the platform provider has all legal obligations towards the platform worker.

It is important to note that the above-mentioned presumption rule currently only applies to proceedings in the context of employment law, and not to proceedings in the context of criminal law, social security or tax law. However, the Draft Directive expressly allows for the possibility that the national legislator may also apply the presumption to social security, tax and criminal proceedings as part of the implementation process.

Potential cost impact for employers

The (re)characterisation of the professional relationship into an employment relationship, with application of all mandatory rules of employment law, has a direct and obvious cost impact for all digital labour platforms.

Allowing for (and without prejudice to) a wide degree of variation among Member States, one can list a number of features of any employment relationship which carry direct cost consequences, such as (i) mandatory insurance coverage (workmen’s insurance, even pension plan coverage), (ii) mandatory benefits (year-end bonus, vacation pay and the like), (iii) guaranteed salary (on occasions such as vacation, incapacity to work, leaves of all kind – maternity, paternity, etc), (iv) statutory protection against dismissal on account of specific circumstances (including discrimination), and (v) rules on termination of the relationship, which tend to be far more protective than any (contractual or statutory) termination of a commercial self-employed contract.

If – as can be expected – Member States would apply the Draft Directive rules also to social security and income tax issues, the cost effect of the Draft Directive clearly becomes all the more cumbersome and onerous for the platforms.

Critical comments

The initial ambitious goals of the platforms workers legislative initiative have clearly been adjusted downwards. Instead of setting throughout the European Union uniform standards, criteria and rules to define an employment relationship in this context (which would have called for some critical comments, including on legislative competence in the field of social policy under article 153 TFEU), the most recent approach reflects political realism.

The most sensitive issues (determination of the employment status of platform workers) have now been delegated to the Member States for regulation. Considering the variation in the EU on this issue, this appears to be a far more realistic approach than the initial one. However, critics rightly fear a patchwork of national regulations that will create even more uncertainty, more or less in line with the patchwork of case-law (on the proper employment status of platform workers) which currently prevails in many Member States.

Hence, the uniform and enhanced protection sought by the protagonists of this legislative initiative may not be that easily attained.

Also, the approach taken - with delegation of key issues to the Member States - raises the question of what will happen in those Member States where a so-called ‘third route’ was created in regulations. This third route – although not directly nor exclusively directed towards gig or platform workers – clearly interferes with the entire discussion of the appropriate or proper status for modern-day workers. Under these regulations, these workers are set somewhere in between the status of self-employed person and an employee (in The Netherlands, France, Germany - also in the UK). How will the new Directive fit in with that approach?

Conscious of the limits of its legislative competence in the area, the Directive’s presumption rule does not extend to social security or tax law. However, many Member States may be tempted by the door opener offered and apply the same rules (criteria and standards for determining the employment relationship) for those specific goals, with a very onerous impact for business and platforms.

So, the next step – after formal adoption of the Directive – is to examine and scrutinise how, to which extent and under which terms the various Member States will transpose the Directive. The patchwork never ends…