Airports and COVID-19: transitioning out of crisis mode

The impact of the ongoing COVID-19 pandemic on the aviation sector has been said to eclipse both the 2010 Icelandic volcano crisis and the 9/11 terrorist attacks, with the spotlight being shone on the airlines struggling to cope with the economic realities of the crisis and the projections for the 'new normal'.

Governments across the world, in particular in the US, have invested heavily to save these businesses from going under, and in turn thrown a lifeline to the enormous markets that are dependent on air travel. One cannot be overly critical of these measures, and the arguments that the aviation sector has been uniquely affected by the pandemic are both clear and compelling; however, it seems in the commentary and analysis that far less attention has been paid to the airports that are very obviously indispensable to the operation of this critical market.

In normal times, airports are diverse and lively businesses. From packed out check-in desks, to well-stocked retail concessions and orderly (or occasionally disorderly) queues at the departures gates, airports thrive on people arriving and departing, with every inch of the passenger's journey designed to ensure the maximum economic efficiency. So with flight schedules operating at best at 10% of pre-pandemic levels, it is clear that airports are being severely hit by COVID-19, and that measures must be taken to ensure that these vital businesses not only survive the immediate economic crisis but that they are also able to come out the other end in a stronger position.

Stuart Cairns, Partner in our London Commercial Team, and Head of our Airports group, sat down (virtually of course) with Nick Boud, Director Airport Consultancy at Helios, global aviation consultants, to discuss the impact of the pandemic on airports, the measures that are being put in place to help the sector, and critically what airports need to do to transition out of crisis mode in order to allow them in the future to once again offer this absolutely crucial service.

Q. Airport clients of ours have told us that this is by far the biggest crisis they have ever faced in business. Many have redeployed staff, put them on furlough or made redundancies, closed terminals and terminated contracts in circumstances that would have seemed unimaginable at the start of the year. What do you see as being the biggest COVID-19 related issues facing the sector, and how well do you think airports are managing these?

Aviation was one of the immediate casualties from the impacts of COVID-19 and certainly is one of the more significantly affected industries. Aviation traffic near enough disappeared within a two-week period. Industry forecasts are changing almost daily, IATA have increased their projections of the financial impact on airlines this year from $63bn to $252bn and then to $314bn, all in a little over one month. Whatever the final figure will be, we know it is bad and is going to be a long recovery.

The greatest impact must be the loss of passenger traffic both in the immediate term and over the months and years of the recovery ahead. For airports, no passengers mean limited aeronautical revenues and no non-aeronautical revenue (i.e. retail, food, beverage, car parking) which can account for 50% plus of their income.

Airports have few opportunities to substantially reduce their costs as so many are related to the major infrastructure that is a fundamental part of an airport – terminals, runways, taxiways, car parks, and all the embedded systems and technology. Numerous airports have consolidated terminal operations allowing them to close some terminals; reducing some of the variable costs.

I think airports are doing all that they can to minimise the impacts on their business but there is little they can do whilst the lockdowns continue. Airport operators are looking and planning for the re-opening and recovery, working with Government departments, airlines, ground handlers, control authorities and industry organisations. Planning to reopen safely is critical to ensure that operations run smoothly minimising delays and inconvenience for all and – crucially - rebuilding passenger confidence in travelling.

Q. Whilst the pandemic is of course a global emergency, it's clear that individual Governments and individual airports are managing their responses in their own ways. We've seen, for example, the European Commission very recently approve a State aid scheme covering the Belgian airports in the Walloon province which allows the airport concessionaires to defer the payment of concession fees to the Walloon authorities. In your view, which of these individual measures are particularly useful, and is there scope for these to be introduced more broadly within the sector?

The financial assistance being offered by governments is welcome and will be critical to the survival of some airports. Not only are different governments offering different support schemes, but airport ownership and operating models vary widely meaning that there is no ‘one-size fits all’ policy. For example, airports ownership varies from 100% public to 100% private with multiple ownership structures between these two boundary cases.

What is clear is that financial support for airports around the world has protected thousands of jobs. However there have redundancies by airport operators and airlines: British Airways and Virgin Atlantic have recently announced redundancies of approximately 30% of their respective workforces. These will not be the last redundancies, particularly if travel remains depressed, and Ryanair and Qatar are just two additional airlines that have stated the potential for substantial job cuts. Globally the aviation industry supports 65.5 million jobs[1] and IATA forecast up to 25 million could be lost if severe aviation restrictions are in place for 3 months, which is currently is looking likely. The “Centre for Cities” think tank has indicated that one in five jobs in communities that depend on the aviation industry are vulnerable to the impacts of COVID-19.

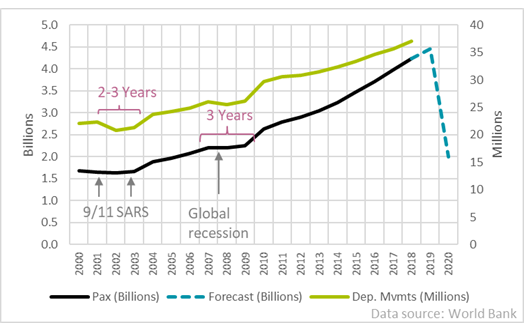

Is there scope to introduce support initiatives more widely within the sector? I am sure there is, but equally the support for aviation is going to be needed far longer than for a lot of industries. Passenger levels took 3-4 years to recover from the 2008 global recession and, given the greater severity of COVID-19, we can expect the recovery to be considerably longer.

With British Airways and Virgin Atlantic announcing their withdrawals from Gatwick, the airport will see a drop of up to 20% in traffic before factoring any other reductions. Regional airports will struggle to make it through this crisis, on top of the collapse of Flybe, and little chance of a peak in traffic over the summer to offset losses incurred during the rest of the year. Sadly, I expect some will fold. The UK government stressed the importance of “levelling up connectivity across UK regions” following both the court defeat for Heathrow’s 3rd runway and Flybe’s collapse, but we don’t know if it will step in to bail out regional airports directly or via funding additional Public Service Obligation routes.

Q. As a law firm which is focused very much on how businesses are being changed by technology and the digital world, we've been particularly interested to see some of the innovations created in response to the pandemic. For example, the recent news that Emirates has become the world's first airline to provide on-site rapid testing of passengers for COVID-19 symptoms or that Airbus has teamed up with Dyson and others to create a new type of ventilator demonstrate that the aviation sector have a part to play in tackling the pandemic. What role is there for airports in this, and have you seen any particularly innovative solutions introduced at airports around the world?

Airports are important gateways, even ‘guardians’, that can help prevent virus diffusion into the wider community. The practical opportunity, aided by technology, should place airports as a role model for others. But they need an effective plan and coordinated approach; and regional airports are going to struggle to adapt if there are significant costs involved.

As you mention, Emirates has started testing departing passengers for COVID-19 antibodies. Etihad is developing health screening booths. A supplier is integrating a body temperature scanner into self-service kiosks, and another is offering thermal imaging camera technology to identify passengers with temperatures for more detailed health screening. Hong Kong Airport is implementing the latest disinfection technologies, including disinfection channels for staff, antimicrobial coatings for public spaces and autonomous cleaning robots[2]. A lot of travellers will understand that such initiatives do not provide total protection; evidence of antibodies only demonstrates that someone has had COVID-19 not whether they are in the early stages of the infection. Similarly you can be contagious whilst not displaying symptoms such as an increased temperature.

The focus of airports is on agreeing the measures to enable recovery:

- The lifting of Government imposed travel restrictions.

- Finding the right balance between what passengers require to feel safe and what is effective based on the scientific evidence.

- Achieving common guidance, practices and / or standards across the industry. Following 9/11 this took a considerable period.

- Supporting airlines and the wider travel industry to build public confidence in booking travel.

Q. Conversations with our airport clients tend to start, understandably, with a discussion about the difficulties of the current situation and the negative impact it's having on their business. However, the conversation quickly turns to: what's next? We've certainly been buoyed to hear airport clients focussing so much on what they need to do to transition out of the pandemic, with many of them using this 'down time' to ensure that they are on the front foot when restrictions are inevitably lifted. In your view, what should airports be doing now to set themselves up for a return to some kind of normality?

A priority for airports is to work across the industry and regulatory bodies to align guidance and practices to protect staff and passengers. Airports could be working with behavioural scientists to identify initiatives to aid in maintaining social distancing; however John Holland-Kaye, CEO of Heathrow Airport Ltd, recently wrote in the Daily Telegraph:

“Forget social distancing – it won’t work in aviation or any other form of public transport, and the problem is not the plane, it is the lack of space in the airport…. Just one jumbo jet would require a queue a kilometre long."

Social distancing of 2m on an aircraft would reduce capacity by approximately 75%, making operation uneconomical. Social distancing cannot be a core part of any future strategy for mass transport systems be it aviation or rail.

I have spoken to an airport client about the fact that communities living close to airports will have become accustomed to the increased peace and tranquillity. When traffic resumes there are likely to be increased complaints and action from community groups, so airports need to develop their communication, engagement and outreach strategies now to mitigate this effect.

We expect airports will be looking at faster adoption of digital and technological solutions, such as the next generation of security screening equipment to reduce person-to-person contact whilst maintaining passenger flow rates, and an increase in the use of facial recognition as a biometric rather than fingerprints that require scanner contact. Working with airlines to increase the functionality of check-in apps such that airport touch screens can be removed at check-in / bag-tag printing kiosks.

A legacy of COVID-19 would be that as a global population we better understand how an “invisible enemy” can trigger unprecedented changes in our daily lives and how vulnerable we are. That this sense of vulnerability will drive continued investment to optimise climate change mitigations and maximise resilience to the impacts of climate change.

Q. Having just spoken about a return to 'normality', there has been much discussion more broadly about the fact that a post-COVID-19 world will never go back to the way it was. How do you see this manifesting itself in the airports' sector? Are there policies, processes and business activities which you see as being changed forever, and will there be any potentially new opportunities for the sector to take advantage of?

The propensity to fly was and is changing through COVID-19, the rise of the “flight-shaming” movement, our newfound confidence in remote working and video conferencing and public perception of the health risk. The recent image of the full Aer Lingus flight from Belfast to London demonstrates some people accept the risks; anyone with serious concerns could have disembarked prior to departure. How quickly confidence can be regained and what the ‘new normal’ will be is still unknown.

There may well be policies instigated by states to require disclosure of medical details in a similar way that advanced passenger information is required for security purposes: if introduced these are likely to become permanent as a mitigation for future pandemics. This raises questions about personal privacy and what citizens should share with a State to be allowed to cross borders.

We foresee an increase in public perception that aviation is bad and green is good, as society has experienced improved air quality and birdsong resonating in gardens during the lockdown. Whilst stepping in to offer airlines financial support[3], governments are attaching conditions to progress public policy objectives. The State aid for Air France has sustainability and CO2 emissions conditions attached to it and funding by the Dutch state to KLM is expected to have similar conditions. State aid to airports could have similar conditions: increased supply of sustainable fuels; reduced CO2 emissions; and reductions in community impact e.g. reducing night flights. Are we seeing the start of greater state intervention, pushing the EU’s Green Deal directly into corporate boardrooms? Aviation must demonstrate more vigorously and effectively that its recovery can be sustainable, although we do not see aviation organisations moving as far as to adopt a “triple bottom line: profit, people and planet” yet.

Aviation is a resilient industry, having recovered from previous shocks, and I believe it will do this again and continue to face climate challenge head on. Aviation is a vital industry helping to drive economies and facilitating connections between inter-continental families and friends, and airports are an essential enabler in this.

Thanks to Nick Boud, Director Airport Consultancy, Helios for his contribution to this article.

Last reviewed: 13 May 2020

[1] 10.2m directly, 10.8m indirectly, 7.8m induced and 36.7m tourism catalytic. Source: https://aviationbenefits.org/economic-growth/supporting-employment/

[2] https://airport-world.com/hong-kongs-airport-begins-use-of-disinfection-technologies/

[3] €7bn for Air France-KLM Group from the French state whilst the Dutch are likely to provide an additional €2-4bn, £770m debt-for-equity swap for Norwegian Air, the Danish and Swedish states have provided guarantees to SAS worth €274m with a commitment from the Danish state to do whatever is necessary to support SAS