National Minimum Wage – A reminder of the common pitfalls

In early July, the names of 239 employers who underpaid the National Living and Minimum Wage were published by the government. A record 22,400 UK workers are to receive a total of £1.44m in backpay, with the employers being fined £1.97m in total, more than in any previous single naming list.

The funding for minimum wage enforcement has more than doubled since 2015 and the government is set to spend a further £26.3m on enforcement during 2018/19. Additionally, the government is currently running a campaign to raise awareness of the National Living Wage and National Minimum Wage rates, as well as encouraging workers who have been underpaid to complain to HMRC.

Employers who fail to pay workers the National Living / Minimum Wage are required to pay arrears of wages at the current minimum wage rates and also face financial penalties of up to 200% of such arrears, capped at a maximum of £20,000 per worker. Aside from the financial penalties, HMRC will also refer the case to the Department of Business, Energy and Industrial Strategy (BEIS) to consider whether to name the employer publicly.

With this in mind, it's a good time for a reminder as to the common pitfalls when calculating the National Minimum/ Living Wage (referred to below collectively as “NMW”). Employers often rely on their payroll software to pick up any irregularities but this is not always fool proof. We have set out below the top five reasons for NMW underpayments in this enforcement round, together with an explanation of how to get it right.

1. Taking deductions from wages for costs such as uniforms

There are certain deductions from wages or payments by workers that reduce pay for NMW purposes – ie. a worker should still be receiving at least the NMW after such deductions or payments have been taken into account. These include expenses incurred by workers in connection with their employment such as the cost of work-related equipment and the purchase and/or cleaning of uniforms.

This point is particularly relevant for employers in the retail, leisure and hospitality sectors where it is relatively common for employers to require workers to wear a uniform. The cost of such uniform may only be lawfully deducted from the worker’s pay (or paid by the worker directly to the employer or a third party) if, following the deduction or payment, the worker’s pay remains at or above the relevant NMW rate.

Other deductions that reduce pay for NMW purposes include deductions or payments by workers for the employer's use or benefit or in respect of living accommodation to the extent such cost exceeds the accommodation allowance (see below).

There are some deductions that do not reduce pay for NMW purposes. These include statutory deductions (for income tax and National Insurance), repayments of an agreed advance or loan, recovery of an overpayment of wages and contractual deductions or penalties.

2. Underpaying apprentices

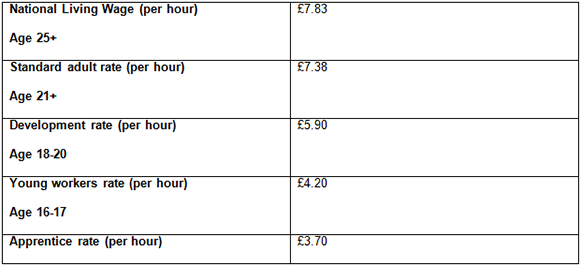

Workers are entitled to the NMW at the apprentice rate if they are: (i) either in the first year of their apprentice or under 19; and (ii) employed under a contract of apprenticeship or apprenticeship agreement, or engaged under certain government apprenticeship schemes. For those over 19 or who have been working as an apprentice for more than 12 months, they are entitled to either the development rate or adult rate of NMW depending on their age (see current rates below).

It is important that employers keep a record of all their apprentices and their dates of birth. This should be reviewed regularly to ensure they are being paid the correct NMW rates. Only genuine apprentices who fall within (ii) above should be paid the apprentice rate. If they are apprentices in name only and are not engaged as such then they should be paid at the relevant age-related NMW rate like other workers. For those genuine apprentices who are over 19, they should be moved onto the relevant age-related NMW rate after the first year of their apprenticeship.

3. Failing to pay travel time

Time spent travelling in connection with employment (including any travel between assignments, where relevant) is treated as working time for NMW purposes. This is distinct from time spent travelling between home and work which does not count towards working time for such purposes.

Training that is approved by the employer and attended during normal working hours is also treated as working time for NMW purposes, irrespective of whether this is held at the normal place of work or elsewhere. Where the training is held outside of the normal workplace, time spent travelling between work and the training venue will also count as working time (although the journey from home to the training venue would not).

Again, employers should keep a record of any business-related travel and time spent training (including any time spent travelling to the training venue) to ensure that this is recorded accurately as working time for NMW purposes.

4. Misusing the accommodation offset

As a general rule, the value of most benefits in kind will not count towards the NMW. However, the exception to this is that the value of any accommodation provided by the employer up to the “accommodation allowance or off-set” (currently £7 a day, although this changes annually) may be taken into account as follows:

- Where accommodation is provided free of charge, a sum equal to the accommodation allowance can be added to the total remuneration when calculating pay for NMW purposes.

- Where a worker pays rent that is equal to or less than the accommodation allowance, this will not impact the NMW calculation.

- However, where a worker pays rent that is greater than the accommodation allowance, the amount charged in excess of the allowance should be treated as a deduction that reduces pay for NMW purposes (see above). In such circumstances, the rent may need to be reduced or the hourly rate increased, in order to ensure the worker is receiving at least the NMW.

The above applies irrespective of whether rent is payable as a deduction from wages or by way of a separate payment from the worker to the employer. It is worth noting that the accommodation allowance or offset includes not only rent but also any charges for utilities.

5. Using the wrong time periods for calculating pay

The pay reference period for calculating hourly pay is one month, or if the worker is paid by reference to a shorter period, that period. Any pay received in that period (or earned in that period, even if it is not received until the following pay reference period) should be taken into account for NMW purposes.

Employers should be careful to ensure that pay is not double-counted. Taking commission as an example, it should be included in the pay reference period during which it was earned. If this is different to the pay reference period when it is received by the worker, it should not then be included in the calculation again.

Current NMW Rates: 1 April 2018 – 30 March 2019

Accommodation offset limit (maximum daily deduction from NMW): £7.00

Further Guidance

In February 2015, the government updated its guidance for employers on calculation of the national minimum wage (see BEIS, Calculating the minimum wage). There is also a regularly updated National Minimum Wage calculator which employees can use to check whether they are being paid the NMW.

Acas has also published its own guidance on the NMW, which is available on its website (see Acas: National Minimum Wage and National Living Wage).