Refining electricity imbalance and balancing prices

ACER's recent report on electricity markets in 2015 highlights areas where it considers further improvements in national electricity balancing markets to be necessary.

ACER's report echoes recent comments from Commission officials, and ties in with a number of the reforms of balancing markets expected in the Commission's new energy market design proposals, expected in its "Winter package" due to be published on 30 November. In this note, we explore some of the regulators' conclusions on the subject of the pricing of electricity imbalances and balancing energy, and some of the issues faced in reforming balancing markets, and outline how a number of national regulatory regimes are currently approaching these issues.

The ACER report

On 16 September, the EU energy regulators published their Annual Report on the Results of Monitoring the Internal Electricity Markets in 2015. The Report is part of a wider Market Monitoring Report, covering gas and retail markets, and customer protection and empowerment. In the electricity markets Report, the regulators examine a number of aspects of EU electricity markets, including cross-zonal capacities, congestion management, unscheduled flows and loop flows, and capacity mechanisms. They consider each of the key electricity market timeframes: forward, day-ahead, intraday and balancing. Their analysis of balancing markets is particularly interesting. In particular, they refer to some of the proposals set out in the draft EU Electricity Balancing Guideline (EB Guideline), that they expect to address deficiencies in current balancing markets. The EB Guideline, one of the EU Network Codes being developed under Regulation 714/2009, recently entered the comitology process and is likely to be adopted early in 2017.

In their Report, as well as reporting on the cross-border exchange of balancing services, which falls outside the scope of this note, the regulators address three key concepts relating to the pricing of balancing: balancing capacity, the price of balancing energy and imbalance pricing.* The latter two in particular are closely related, with a number of Member States applying the same pricing approach to both. Concepts such as marginal pricing and scarcity pricing therefore overlap both contexts, but in this note the pricing of balancing energy and imbalance pricing are addressed separately.

Impact of balancing capacity procurement

The regulators report that in most Member States, the cost of procuring balancing capacity represents the largest share of the costs of balancing. In Austria, for example, the cost of procuring balancing capacity accounts for just over 80% of the total balancing cost. In a number of EU countries it is well over half of the cost. According to the regulators, the high proportion of capacity procurement costs in the total price paid to balancing services providers dilutes the energy element, and makes it less attractive for balancing services providers to respond to immediate balancing needs.

The regulators point to rules for improving the procurement of balancing capacity under the EB Guideline as an important future step in reducing procurement costs. The measures set out in the current draft of the EB Guideline include the introduction of shorter procurement periods (maximum one month), shorter periods between procurement and contracting (also one month) and procurement using market-based methods (i.e. with an element of price competition, for example through an auction). Importantly, in order to enhance competition, national rules must allow the aggregation of demand response and generation facilities, and participation by demand facilities, third parties (e.g. aggregators), renewable as well as conventional generators and storage providers. New proposals on balancing capacity procurement will be an important feature of the Winter package.

Pricing for balancing energy

The Report also highlights the importance of correctly pricing balancing energy. It notes that the draft EB Guideline envisages the use of marginal pricing as the basis for the price of balancing energy services. The current draft provides for all TSOs to develop a proposal, within a year of the EB Guideline entering force, for a harmonised method for determining the electricity balancing price. This balancing price is to be based on marginal pricing, unless TSOs demonstrate that an alternative method would be more efficient.

The marginal energy price is the price of the highest-priced balancing bid or offer accepted by the system operator in a particular balancing market period. All balancing bids and offers accepted during that period then receive that marginal price. A marginal pricing approach is often referred to as a "pay-as-cleared" approach. This is contrasted with a "pay-as-bid" approach, in which each balancing services provider is paid its bid or offer price. Marginal pricing is widely considered to deliver pricing signals that better incentivise both efficient dispatch in the short term and efficient investment in the longer term. However, the ACER Report notes that a number of Member States still apply "pay-as-bid" rules. These are therefore likely to need to change in order to align with marginal pricing proposals arising from the EB Guideline. The Commission's new energy market design proposals will also require the introduction of marginal balancing energy prices.

The draft EB Guideline sets out one important exception to the marginal pricing of electricity balancing bids and offers. This is that where balancing energy bids or offers are activated for purposes other than balancing (i.e. for "non-energy" or system reasons such as providing voltage support) the price of those bids and offers must not be taken into account in the calculation of the marginal price. This avoids "pollution" of the marginal price by potentially higher-priced balancing actions that reflect system constraints rather than the need to balance the energy in the system.

Imbalance pricing

The draft EB Guideline also sets out rules for imbalance pricing. ACER's framework principles for the drafting of the EB Guideline required the imbalance price to reflect the costs of system balancing in real time. The draft EB Guideline provides that imbalances must be priced by reference to the price of activated energy (positive or negative) for frequency restoration reserves and replacement reserves, i.e. the cost of reserves that are activated at very short notice. In the longer term, it also provides for the harmonisation of imbalance prices, based on common price components and single imbalance pricing as the preferred approach.

A number of Member States have already adopted or are considering the adoption of single imbalance pricing. This is where a party whose imbalance is in the opposite direction to the overall direction of the system (e.g. a party that is long when the system is short, and therefore contributes to the reduction of the system imbalance) faces the same imbalance price as a party whose imbalance is in the same direction as the overall direction of the market (e.g. a party that is long when the system is long, and that therefore aggravates the system imbalance).

In contrast, a dual imbalance price is where a party with an imbalance contributing to the system imbalance faces a price that reflects the cost of balancing, while a party with an imbalance reducing the system imbalance faces a different price – frequently a market price. The rationale of the dual price is that a party that has contributed to the system imbalance should contribute to the cost of balancing it, and should be exposed to the cost of balancing it. However, a party with a "reducing balance", i.e. one that has reduced the system imbalance, should receive or pay the price that it would have received or paid if it had traded out its imbalance in the intraday market.

Dual prices have faced increasing criticism, however, on the grounds that the market price paid to parties that have reduced the system imbalance is not cost-reflective, and is inefficient because it over-incentivises parties to be in balance. The market price does not allow parties with helpful imbalances to share the cost-savings and benefits to the market.

A single imbalance price addresses these concerns, because it reflects the balancing costs avoided. This is thought to be particularly beneficial to smaller players who often have reducing imbalances. As the basis for the single imbalance price, the Commission favours marginal pricing (as it does for the pricing of balancing energy, discussed above). However, this is not expressly built into either the short-term rules for national imbalance pricing (because the reference price – the price of activated reserves - will not necessarily be the marginal price) or the long-term harmonised rules. The Commission's new energy market design proposals are expected to impose a requirement to develop an imbalance price that reflects the real-time value of energy.

Following a lengthy "Electricity Balancing Significant Code Review", the GB energy regulator Ofgem recently directed Modification P305 to the Balancing and Settlement Code that, in addition to introducing a single imbalance price (known as the "cash-out" price in the GB market), also made the cash-out price more marginal. It reduced the Price Average Reference (PAR) volume, the volume of the most expensive balancing actions used in calculating the cash-out price, from 500 MWh to 50 MWh, and will then reduce it to 1 MWh on 1 November 2018. This is intended to lead to a more responsive cash-out price, allowing it to reflect more accurately the true cost of the most expensive short term actions to balance the system.

Scarcity pricing

However, as ACER points out in its Report, even moving toward marginal pricing is not necessarily sufficient to enable efficient price formation at times of scarcity. There are a number of reasons for this – in particular that the costs to consumers of a possible load reduction, known as the value of lost load (VOLL), are not usually taken into account in calculating the balancing energy price, and that prices are constrained either by actual price caps or floors, or by the fear of regulatory action if high prices are offered. Significantly, in his speech to the Florence Forum in March this year, EU Energy Commissioner Cañete referred to scarcity pricing, apparently in all timeframes, as being the key to ensuring "viable and investment friendly" energy systems.

Somewhat surprisingly, however, the Commissioner mentioned only the removal of price caps as a means of achieving this. In the case of the balancing market, the particular concern is expressly addressed in the draft EB Guideline, which prohibits caps and floors on energy balancing prices.

ACER's report outlines further steps that could be taken to send better pricing signals. In addition to proposing that balancing services providers should be permitted to seek high prices at times of scarcity (and presumably should also be shielded from allegations that they have engaged in market abuse merely by virtue of charging high prices for balancing energy), ACER also specifically discusses the introduction of scarcity pricing. The Commission's new energy market design proposals are expected to incorporate a scarcity pricing component in a number of contexts.

Scarcity pricing is already being introduced or considered in a number of national markets, and typically involves adding into the balancing energy price a component based on the value of lost load (VOLL) and loss of load probability (LOLP). ACER notes that the Belgian energy regulator, the CREG, recently published an interesting note entitled "Scarcity pricing applied to Belgium" setting out its initial analysis of the possible introduction of scarcity pricing based on the Operating Reserve Demand Curve (ORDC) approach employed in the Texas electricity market. This approach is based on the principle that where there is a load curtailment and the system has the minimum level of contingency operating reserves, any increase in those reserves would reduce the load curtailment, and should therefore be priced at the value to the customers of the loss of load that they thereby avoid, i.e. VOLL. At any other level of operating reserves, the value of an increase in reserves would be VOLL multiplied by the probability (represented by LOLP) that the load will increase sufficiently to reduce the reserves to a level at which load curtailment will occur.

This combination of VOLL and LOLP results in a figure that is reflected in the reserve price, or in the Belgian proposal would be added to the balancing price. One advantage of this approach is that adding the scarcity component administratively allows balancing services providers to price balancing bids and offers without needing to reflect scarcity themselves, thereby addressing some of the concerns, outlined above, that very high prices may expose them to regulatory action.

The CREG is investigating the ORDC model further, although it notes that EU developments under the draft EB Guideline and discussions on scarcity pricing may also affect its adoption of these arrangements. Similarly, the GB Electricity Balancing Significant Code Review recently introduced reserve scarcity pricing (RSP) to price short-term reserves into the cash-out price. RSP also reflects VOLL. Interestingly, however, the figure for VOLL used in the GB RSP is £6,000/MWh (increasing from £3,000/MWh). The UK Competition and Markets Authority, as part of its recent energy market inquiry, noted that this was significantly lower than the VOLL of £17,000/MWh used by the government in setting the capacity requirement for the GB capacity market. The CMA criticised the RSP as institutionalising the missing money problem in the GB market by setting a figure for scarcity in the balancing markets that does not properly incentivise longer term investment.

The Finnish TSO Fingrid has also proposed scarcity pricing in its paper entitled "Electricity market needs fixing – What can we do?" This paper outlines two alternative scenarios for securing future system adequacy and security, one based on central control and the other intended to reduce the need for intervention outside the market by improving price signals. A key element of the market-based approach is the proposed introduction of scarcity pricing. Prices in the balancing market are currently capped at €5,000/MWh. This effectively acts as a cap on the imbalance price too. Fingrid's proposal is to apply a scarcity "adder", reflecting VOLL, to balancing energy price in order to produce the imbalance price. Fingrid also proposes shorter imbalance settlement periods, single imbalance pricing and more flexible participation in balancing markets.

The proposed balancing market under the I-SEM

In Ireland and Northern Ireland, the current Single Electricity Market for the island (a gross mandatory pool) requires considerable change in order to align it with the EU internal energy market. It will be replaced by the I-SEM, an electricity market (or more correctly electricity markets, as it will introduce forward, day-ahead and intraday markets in accordance with the FCA and CACM Network Codes), as well as a new capacity market based on reliability options. The I-SEM will also introduce a balancing market through a revised Trading and Settlement Code. The need to create an entirely new balancing market has allowed the market design to address a number of the issues discussed above at the same time.

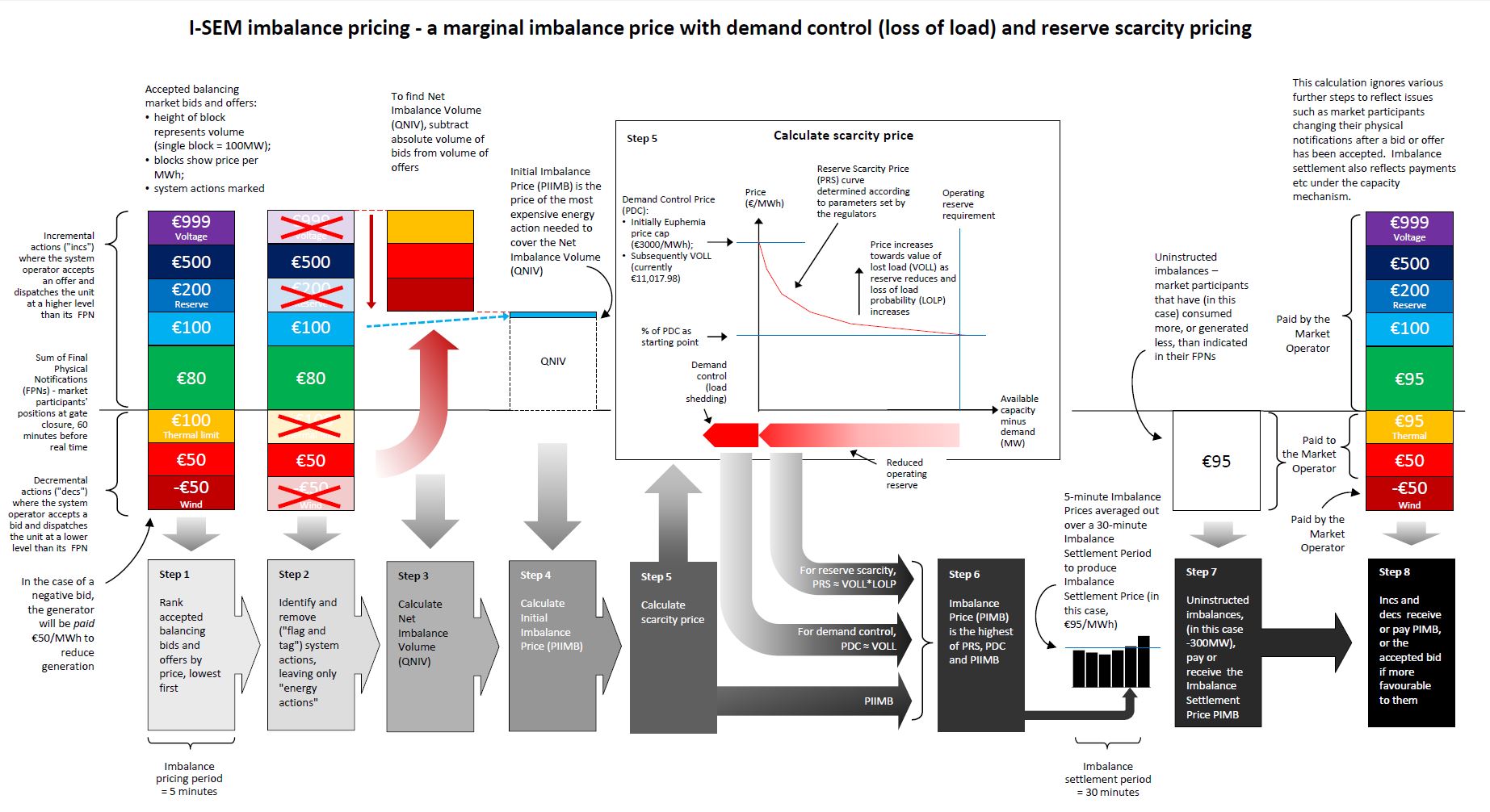

The latest published draft of the TSC displays a number of interesting features, and takes considerable care to develop the cleanest possible formulation of the imbalance price, with numerous steps to ensure that the price is not distorted by system actions, very small actions that might have a disproportionate effect on price, etc. The imbalance price is initially calculated over 5-minute imbalance pricing periods. Bids and offers accepted for system reasons will be excluded from the marginal price calculation by a process known as "flagging and tagging" similar to the GB approach. Under this process, balancing bids and offers that may have been accepted for system reasons (e.g. in order to comply with thermal or voltage limits) rather than energy reasons will be identified and then removed from the price stack used to calculate the marginal price.

A further process, known as Net Imbalance Volume (NIV) tagging, ensures that the marginal price is the price of the most expensive action used to address the energy imbalance. The draft rules also incorporate scarcity pricing. Where reserves are limited and the system operators have had to take demand control actions (load reduction), the imbalance price in respect of those actions is set at the full administered scarcity price. This will initially be set the market price cap (€3,000/MWh) used in the Euphemia day-ahead market price algorithm, but will increase to VOLL (currently €11,017.98/MWh) after a transitional period.

The I-SEM proposals also include a reserve scarcity pricing mechanism similar to the ORDC mechanism being considered by the Belgian regulator. This provides for the administered scarcity price to rise towards VOLL the more likely it is that reserves will be exhausted. The imbalance price is the higher of the price of the marginal energy balancing action and the demand control/reserve/scarcity price. The resulting imbalance prices of 6 imbalance pricing periods are then averaged to provide a half-hourly imbalance settlement price. This is then used (with various further adjustments) as the basis for both imbalance pricing and the pricing of balancing energy.

The I-SEM approach to imbalance pricing calculation is set out, in simplified form, in a diagram here.

Conclusion

A number of European electricity markets, as well as the EU energy regulators through ACER and the European Commission, are currently grappling with the need to reform balancing markets, with various types of measures being considered in order to ensure that the markets send proper price signals. This is an increasingly important consideration in the light of ever higher renewables penetration, and flexible plant being run more intermittently. The introduction or refinement of marginal imbalance pricing and scarcity pricing are two of these measures. A particularly interesting example is the I-SEM in Ireland and Northern Ireland, which is using the creation of an entirely new balancing market as an opportunity to adopt best practice.

*It may be useful to set out here some of the terminology used, paraphrasing the definitions used in the current draft of the EB Guideline.

Balancing energy: energy used by transmission system operators to perform balancing, and provided by a balancing services provider

Balancing capacity: a volume of reserve capacity which a balancing service provider has agreed to hold, and for which it has agreed to submit bids to the TSO for a corresponding volume of balancing energy for the duration of the agreement

Imbalance: the difference between the volume of energy actually introduced into or taken from the system and attributed to a market participant and the volume that it notified to the TSO