The Modernisation of Global Tax System

Pillar Two is a global minimum tax initiative spearheaded by the OECD. Its primary goal is to ensure that large multinational enterprises (MNEs) pay a minimum level of tax on income generated in each jurisdiction where they operate. This initiative aims to address tax avoidance strategies that allow MNEs to shift profits to low-tax jurisdictions, thereby ensuring a fairer distribution of tax revenues globally.

The global minimum tax under Pillar Two will be implemented in over 140 countries worldwide. It imposes both a tax obligation and an administrative duty on the targeted enterprises. Specifically, this minimum tax will apply to MNEs that do not meet the required Effective Tax Rate (ETR) in the jurisdictions where they operate. By setting a floor for tax rates, Pillar Two seeks to curb the race to the bottom in corporate tax rates and promote tax fairness.

In the European Union, a directive has been adopted to enforce this global minimum tax across all EU Member States. The directive mandates that Member States incorporate the provisions of Pillar Two into their national laws by 31 December 2023. These laws should apply to all fiscal years beginning from 31 December 2023.

What is the impact on MNEs and and how to navigate such impact in practice?

Pillar Two compliance goes beyond tax departments. Boards, C-level leaders, accounting teams, and legal teams, must ensure that their organisations are prepared for the complex data collection and reporting mandates.

Organisations will need to rethink their decision-making processes. MNEs must adopt a new approach to data gathering. Robust systems are needed to collect and analyse financial and operational data across jurisdictions. This data will drive compliance and strategic decision-making.

Remember, the introduction of Pillar Two is a transformative moment for MNEs. It requires proactive planning, collaboration, and strategic alignment, which may also affect other taxes and obligations such as VAT and DAC6, as well as areas beyond tax such as employment. Pillar Two introduces a fresh perspective on tax strategy and risk management. The Pillar Two impact should be on the agenda during every business expansion, asset transfer, share transfer and other business changes.

As such, it’s important to consider how Pillar Two affects your business.

We will provide you with a comprehensive outline of Pillar Two taxation and its compliance requirements. This will include:

- Scope (Which organisations fall within the scope of Pillar Two?)

- Effective Tax Rate (What is the Effective Tax Rate and how is it computed?)

- Charging Provisions (Who is taxed?)

- Exemptions (Are there any relaxations?)

- Compliance requirements (What is expected from MNEs?)

- Recommendations/impact on businesses (What can businesses do?)

The global minimum tax will apply to large multinational enterprises (and domestic groups), which have a consolidated turnover of more than EUR 750 million. This EUR 750 million threshold is determined on the basis of the consolidated financial statements of the ultimate parent entity of the MNE. The threshold has been met if the annual turnover is at least EUR 750 million:

- in at least two of the four financial years immediately preceding the relevant financial year; or

- if less than four financial years have preceded the financial year, in at least two of the financial years immediately preceding the financial year.

Excluded entities

Pillar Two does not apply to so-called excluded entities. Excluded entities contain – in short – the following (conditions apply):

- Governmental entities;

- International organisations;

- Non-profits;

- Pension funds;

- Investment funds that are an ultimate parent entity;

- Real estate investment vehicles that are an ultimate parent entity.

In certain circumstances, entities which are owned by an excluded entity may also qualify as an excluded entity.

Excluded entities are not included for calculating the ETR, any top-up tax payment, and compliance requirements. However, the turnover of excluded entities is taken into account for determining the EUR 750 million threshold.

The Pillar Two regulations ensure the ETR in each jurisdiction is at least 15%. Consequently, the ETR is calculated collectively for all the entities in a given jurisdiction.

The ETR is determined by taking the covered taxes in a jurisdiction and dividing it by the qualifying income.

𝐶𝑜𝑣𝑒𝑟𝑒𝑑 𝑡𝑎𝑥𝑒𝑠÷𝑄𝑢𝑎𝑙𝑖𝑓𝑦𝑖𝑛𝑔 𝑖𝑛𝑐𝑜𝑚𝑒=𝐸𝑓𝑓𝑒𝑐𝑡𝑖𝑣𝑒 𝑇𝑎𝑥 𝑅𝑎𝑡𝑒 (𝐸𝑇𝑅)

Qualifying income

The qualifying income is computed as follows:

- The starting point is the net income in the financial accounts.

- Some adjustments need to be made to align tax base with what is typically applied for local tax purpose in that jurisdiction. These can include:

- Tax expenses

- Excluded dividends

- Excluded equity gains or losses

- Included revaluation method gains or losses

- Gains or losses from disposition of certain assets and liabilities

- Asymmetric forex gains or losses

- Policy disallowed expenses (such as fines)

- Prior period errors and changes in accounting principles

- Accrued pension expenses

- Transfer pricing adjustments and intra-group financing

Covered taxes

For the purposes of Pillar Two, covered taxes shortly include all taxes imposed on an entity's profits or income, excluding top-up taxes. Some adjustments should be made for temporary differences and losses, such as tax credits.

Top-up tax

If an MNE does not achieve the 15% ETR in a particular jurisdiction, a top-up tax will be applied to reach the 15% threshold. For example, if the ETR in a jurisdiction is 10%, a 5% top-up tax will be imposed.

The top-up tax is implemented through three distinct charging provisions: the Qualified Domestic Minimum Top-up Tax (QDMTT), the Income Inclusion Rule (IIR), and the Undertaxed Profits Rule (UTPR). These provisions determine which jurisdiction has the authority to levy the top-up tax on specific entities.

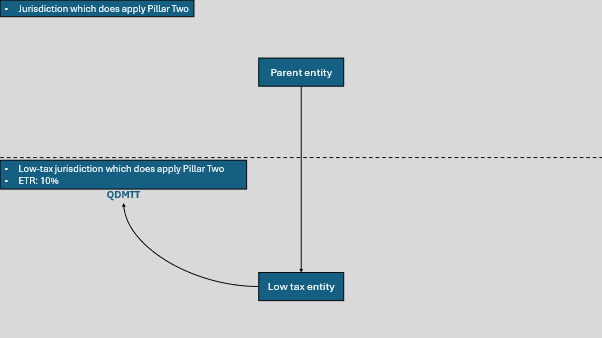

Qualified Domestic Minimum Top-up Tax

This rule imposes a tax obligation on jurisdictions where companies of an MNE fall below the 15% ETR. The jurisdiction must then levy a top-up tax on the undertaxed entities within its territory. The QDMTT has priority over the other two rules.

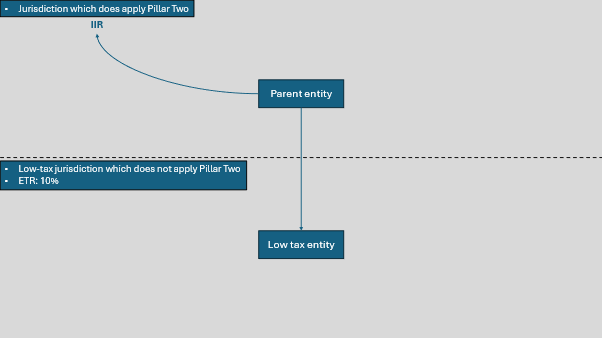

Income Inclusion Rule

The Income Inclusion Rule imposes a tax obligation on the jurisdiction where the ultimate parent entity of an MNE is located. If this ultimate parent entity has subsidiaries in other jurisdictions where the ETR is below 15%, the jurisdiction of the ultimate parent entity must levy a top-up tax. If the ultimate parent entity is not in a jurisdiction that applies Pillar Two, the IIR shifts downward to a subsidiary located in a jurisdiction that does apply Pillar Two. The IIR has priority over the UTPR.

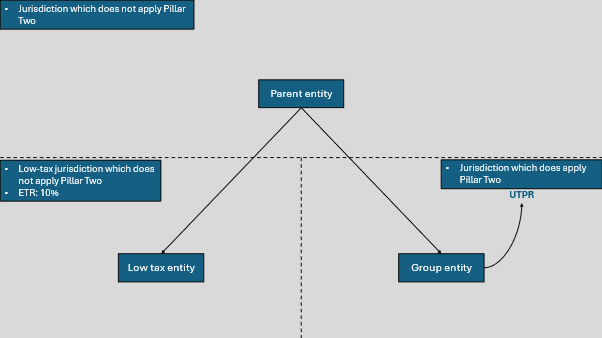

Undertaxed Profits Rule

The Undertaxed Profits Rule only applies if the previous two rules did not. The UTPR functions like a backstop for Pillar Two. The rule allocates the top-up tax obligation between jurisdictions which (1) apply this rule and (2) in which the MNE has group entities. The allocation is in proportion to the number of employees and tangible assets of the MNE in those jurisdictions.

To relieve the administrative burden and the complexity of Pillar Two, some exemptions have been introduced. The most important ones will be discussed below.

The Safe Harbour provisions are the most significant exemptions. Safe Harbours would allow an MNE Group to avoid the difficult and tedious ETR and Top-up Tax calculations in respect of its operations that are likely to be taxable at or above the minimum rate. There are two different kinds of Safe Harbours: The Temporary and Permanent Safe Harbours.

Temporary Safe Harbours

The Temporary Safe Harbours are designed to bring some relief in the transitional period of introducing Pillar Two.

Transitional Safe Harbour (CbCR) (Country-by-Country report)

- The transition period covers all of the fiscal years beginning on or before 31/12/2026 but not including a fiscal year that ends after 30/6/2028.

- Under the Transitional Safe Harbour, the top up tax for a certain jurisdiction is deemed to be zero in a fiscal year if there is a qualifying CbCR and one of the following three tests is met in that jurisdiction (conditions apply):

-

Minimis-test:

- The total qualifying income is less than EUR 1,000,000

- The total qualifying turnover is less than EUR 10,000,000

- The total qualifying income is less than EUR 1,000,000

- Simplified ETR-test

- This test is met if the group-entities in a jurisdiction have a simplified ETR that is equal or greater than the transitional tax rate.

- The simplified ETR is calculated by dividing the jurisdiction’s simplified covered taxes by the jurisdiction's simplified profit.

- Simplified Tax: The amount of covered tax in the jurisdiction, which is reported in the financial statements of the MNE in a qualifying CbCR. These do not include uncovered taxes and uncertain tax positions.

- Simplified Profit: The by the MNE in a qualifying CbCR reported profit before income/corporate tax.

- The transitional tax rates are:

- For tax years beginning in 2023 and 2024: 15%

- For tax years beginning in 2025: 16%

- For tax years beginning in 2026: 17%

- For tax years beginning in 2023 and 2024: 15%

- This test is met if the group-entities in a jurisdiction have a simplified ETR that is equal or greater than the transitional tax rate.

- The qualifying income can be diminished by the substance bases income exclusion.

- The substance-based income exclusion roughly works as follows:

- 2024: 9,6% of payroll expenses and 7,6% of tangible assets are excluded from the qualified income.

- 2025: 9,4% of payroll expenses and 7,4% of tangible assets are excluded from the qualified income.

- 2024: 9,6% of payroll expenses and 7,6% of tangible assets are excluded from the qualified income.

- If this excluded income in a jurisdiction is bigger than the qualifying income, the Routine Profits Test is met.

Transitional UTPR Safe Harbour

- If the Undertaxed Profits rule is applicable to an MNE, no tax will be levied of the group entities which are situated in the same jurisdiction as the ultimate parent entity, provided that this jurisdiction has a corporate income tax rate of at least 20%.

- Transition Period for the Transitional UTPR Safe Harbour means the fiscal years which run no longer than 12 months that begin on or before 31 December 2025 and end before 31 December 2026.

Permanent Safe Harbours

The Permanent Safe Harbours provide a lasting relaxation of the administrative burden. Note these Safe Harbours still must be requested/applied annually.

Simplified Calculations Safe Harbour

The top-up tax in a jurisdiction will be deemed zero in a fiscal year if the group entities in a jurisdiction meet at least one of the following tests:

- Minimis-test:

- The total qualifying income is less than EUR 1,000,000

- The total qualifying turnover is less than EUR 10,000,000

- The total qualifying income is less than EUR 1,000,000

- Simplified ETR-test:

- This test is met if the group-entities in a jurisdiction have a simplified ETR that is equal or greater than the minimum tax rate (15%).

- The simplified ETR is calculated by dividing the jurisdiction’s simplified corporate taxes by the jurisdiction's simplified profit.

Simplified Tax: The amount of covered tax in the jurisdiction, which is reported in the financial statements of the MNE. These do not include uncovered taxes and uncertain tax positions.

- Simplified Profit: The by the MNE reported profit before income/corporate tax.

- The minimum tax rate is 15% for the simplified ETR-test under the permanent Safe Harbour

- This test is met if the group-entities in a jurisdiction have a simplified ETR that is equal or greater than the minimum tax rate (15%).

- Routine Profits Test

- The qualifying income is less than the amount that results from the substance-based income exclusion.

Qualified Domestic Minimum Top-up Tax Safe Harbour

- This Safe Harbour entails that the top-up tax in a certain jurisdiction is zero if the entities in that jurisdiction are already subject to the jurisdiction’s Qualified Domestic Minimum Top-up Tax. So, if an MNE is subject to a QDMTT, no further calculations need to be made for another top-up tax in that jurisdiction.

Information return

Pillar Two introduces significant administrative obligations for MNEs. Firstly, the MNEs which are in scope of the Pillar Two regulations need to file an annual information return. The information return is a standardised template designed to give tax authorities the necessary details to assess the accuracy of an entity’s tax obligations under Pillar Two. The information return is due 15 months after the ending of the relevant fiscal year. For the first fiscal year within the scope of Pillar Two, the deadline is 18 months.

An entity is exempt from filing an information return if another group entity within the same jurisdiction has already done so. Additionally, an entity is exempt if a group entity in another jurisdiction has filed an information return with its local tax authorities, and those authorities have forwarded the information return to the relevant tax authority in the other jurisdiction.

If an entity is exempt from filing an information return, it must still inform its local tax authority about which other entity will be submitting the information return.

Tax return

If any top-up tax is due based on the QDMTT, IIR or UTPR for the reporting year, a tax return must be filed and the tax due should be paid. The tax return must be filed, and the tax due must be paid no later than seventeen months after the last day of the reporting year. For the first reporting year within the scope of Pillar Two, the deadline is twenty months.

So, for fiscal years starting at the 1 January 2024 and ending on December 31, 2024, the deadlines are:

- June 30, 2026 for the information return and;

- August 31, 2026 for the tax return and payment.

Deadlines and conditions for Pillar Two may differ in each jurisdiction due to different implementations into local law. Above mentioned deadlines and conditions are based on the EU-directive.

Pillar Two will significantly impact MNEs that fall within its scope. This global minimum tax introduces complex data collection and reporting obligations that require detailed attention. MNEs must establish elaborate systems for data collection across multiple jurisdictions, ensuring that all relevant financial information is accurately captured and reported by the right entity.

To comply with Pillar Two, different entities within an MNE must communicate and collaborate effectively. This involves the intragroup distribution of data related to profits, taxes paid, and other financial metrics. Ensuring compliance with Pillar Two rules requires a coordinated effort where each entity within the MNE shares relevant information promptly and accurately.

But first, MNEs need to assess whether they currently fall within the scope of Pillar Two and understand the associated obligations. Additionally, MNEs should evaluate whether they might fall within the scope of Pillar Two in the future. For example, MNEs could suddenly fall within the scope of Pillar Two after a merger or acquisition if the new group has a consolidated turnover exceeding EUR750 million. Therefore, it is crucial to make a Pillar Two assessment before such transactions. This way, necessary preparations can be taken to be ready for Pillar Two compliance. We would be happy to facilitate a Pillar Two scoping assessment.

As a first step, start with a kick-off impact assessment by reviewing your tax governance, structure chart and the financial accounts. We would be happy to facilitate a Pillar Two kick-off workshop and start the discussion on Pillar Two scoping with a goal to stay ahead of the curve.

Digital Services Tax

During these Pillar discussions on a global level, several countries introduced a so-called Digital Services Tax.