London Court of International Arbitration (LCIA) reports record caseload for 2020

The London Court of International Arbitration (the “LCIA”) recently published its Annual Casework Report looking back on case statistics and other metrics across an exceptional 2020 marked by pandemic lockdowns, economic turmoil, and record numbers for LCIA arbitration.

All Time Highs

2020 saw the LCIA achieve all-time highs with 444 referrals and 407 arbitrations pursuant to the LCIA Rules. This continues a long-term trend which has seen the LCIA achieve a doubling of arbitrations over the past decade.

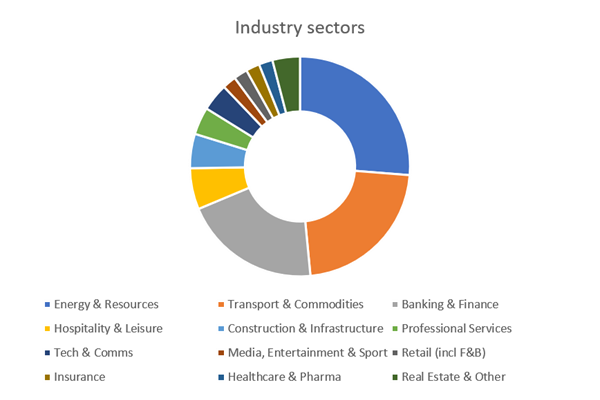

The LCIA’s 2020 caseload was dominated by cases from its top three industry sectors:

- energy & resources,

- transport & commodities, and

- banking & financing.

Between them, these three sectors accounted for 68% of all arbitrations pursuant to the LCIA rules in 2020.

Within the various sectors, the LCIA also considered the agreement type giving rise to the disputes referred to arbitration. This showed that the agreements seen in the arbitrations mostly fell into four categories:

- sale of goods agreements,

- services agreements,

- shareholders/JV/share purchase agreements, and

- loan/facility agreements.

These four types of agreements generated 81% of the cases referred to the LCIA in 2020.

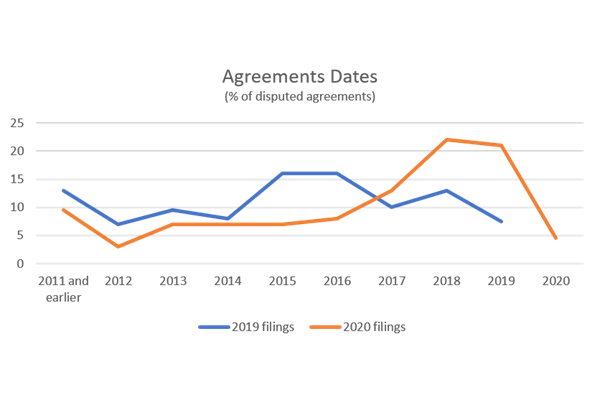

Most of the LCIA’s arbitrations arose out of agreements made in the previous 5 years. However, within this period, the LCIA observed a “sharp increase” in the number of disputes being referred to the LCIA within 2 years of entering into the disputed agreement which rose from 23% in 2019 to 43% of cases referred in 2020. The LCIA views this spike as seemingly driven by the impacts of the COVID-19 pandemic.

International Status

The LCIA reported growth in the numbers of non-UK parties in its 2020 caseload. Non-UK parties accounted for nearly 87% of disputants in 2020, showing an increase of over 5% from the year before. Interestingly, where UK parties were involved, almost half of those cases involved a UK party on the other side.

Perhaps surprisingly given its status as a symbol of London as an arbitration seat, some 16% of the LCIA’s 2020 caseload involved a seat of arbitration outside the UK (up from 11% in 2019).

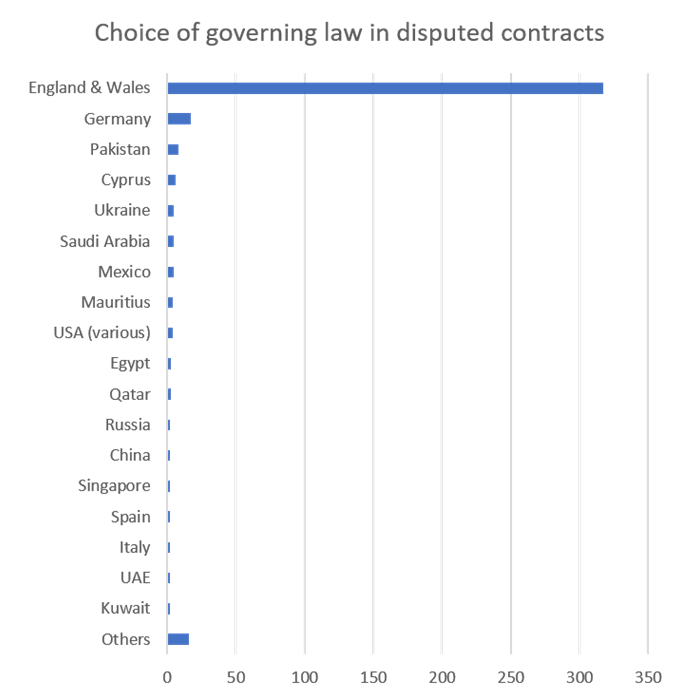

In keeping with the trend of growing internationalism, the LCIA saw a small increase in cases where English was not the governing law of the contract, although English law remained by far the most popular choice among the disputes contracts.

Arbitrator appointments

2020 saw the LCIA Court make a total of 553 arbitrator appointments comprising 42% of all arbitrator selections in arbitrations under the LCIA rules. As usual, there was a low number of challenges to appointments in 2020 with only 6 challenges of which just 1 was upheld.

Impact of the COVID-19 Pandemic

Like many institutions, the LCIA felt the impact of the COVID-19 pandemic on its operations with many staff having to work from home, a move to electronic documentation, and of course virtual hearings. Helpfully, the 2020 revisions to the LCIA Rules came into effect in this period helping to codify some of the changes in approach necessitated (or super-charged) by the pandemic, including an explicit power for the tribunal to order virtual hearings.

Conclusion

The busy year reported by the LCIA in 2020 is consistent with activity levels at other major arbitral institutions and is most likely a prelude to an even busier 2021 as more of the effects of the pandemic play out in commercial disputes, and the impact of the implementation of Brexit on intra-European commerce also starts to be felt. London and the LCIA, amongst other institutions, appear well placed to serve that demand.

For further arbitration related content click here to visit Disputes+, Bird & Bird’s dispute resolution know how portal.