Changes to the calculation of Post-Employment Notice Pay

Further changes to the formula used to calculate Post-Employment Notice Pay ("PENP") were introduced on 6 April 2021.

The current position

From 6 April 2018, a new regime of "PENP" was implemented to tax, as earnings, the basic pay an employee would have earned had the employee worked their notice period in full and to subject that amount to class 1 national insurance contributions ("NICs"). Under the current regime, employers must treat the slice of any relevant termination award which reflects basic pay for any part of a notice period that is not served (calculated according to a statutory formula) as earnings and subject that slice to tax and NICs (both employer and employee).

Prior to this, the tax treatment of payments in lieu of notice ("PILONs") depended on whether an employee's contract contained a PILON clause, with the result that only contractual PILONs were taxed as earnings and subject to class 1 NICs. The balance of any termination payment (or the whole of it if there was no PILON) was taxed as an ex-gratia termination payment with the first £30,000 being tax free and the whole payment free of NICs.

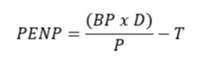

The standard formula used to calculate PENP as set out at section 402D(1) of Income Tax (Earnings and Pensions) Act 2003 is:

Where:

"BP" is basic pay in the last pay period. Where an employee is serving part of their notice, this is the pay period ending before the date on which the notice is served. Where an employee receives a payment in lieu of their whole notice period, this is the last day of their employment.

"D" is the number of days in the employee's notice period falling after the termination of employment;

"P" is the pay period in days; and

"T" is the sum paid on termination (other than holiday pay and termination bonuses) that is taxable as earnings (typically any contractual PILON).

New Rules

In October 2019 and December 2019, HMRC published an alternative formula that could be used for calculating PENP where:

- the employee's last pay period relevant to the PENP calculation is a month;

- the employee’s salary is paid by 12 equal monthly instalments; and

- the employee's post-employment notice period is not a whole number of months (if the notice period is a whole number of months, the normal calculation by reference to months should be used instead).

In these circumstances, the employee could substitute 30.42 (being 365 ÷ 12) as the value of P in the PENP formula (as set out below), provided it benefits the employee to do so. This change addressed a shortcoming in the standard formula, which produced different results depending on when in the year notice was given (i.e. the standard formula can be skewed and result in a higher PENP if the last pay period falls in a short month as opposed to a longer month).

However, the position has now changed so that the use of the alternative formula to calculate PENP has become mandatory (having previously been optional) in circumstances where both an employee's employment is terminated and a termination payment is received on or after 6 April 2021.

Example

The change is best illustrated by way of example:

Take an employee who is paid a salary of £36,000 by equal monthly instalments of £3,000 on the first day of each month. Her employment is terminated on 1 March with no PILON and she is entitled to 2 weeks’ (14 days’) notice. Her last pay period is 1 February to 28 February. She receives a termination payment of £10,000, part of which will be PENP.

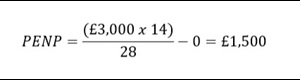

Under HMRC's standard PENP formula:

"BP" is is £3,000;

"D" is 14;

"P" is 28 (the number of days in the February pay period before notice of termination is given); and

"T" is 0.

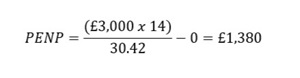

However, following these changes to the PENP calculation, the employer must substitute 30.42 as the value of P. Therefore, under the new formula:

This means that £1,380 of the £10,000 termination payment is PENP and therefore subject to tax and employer and employee NICs. In this example, the new formula benefits the employee, since under the previous formula £1,500 of the £10,000 termination payment was taxable.

Territorial Reach

The new rules impact employees who physically perform their employment duties in the UK and have their employment terminated with a termination payment made on or after 6 April 2021. Whether an employee is UK resident in the year their employment terminates is irrelevant, as the tax treatment of PENP for UK residents and non-residents with respect to their UK employment is now aligned. Previously, employees (or former employees) not resident in the UK for the tax year in which their employment terminates were eligible for foreign service relief in relation to PENP.

Employer Impact

Employers that are yet to do so should update the systems used to calculate PENP to address the change in the formula. This will help employers ensure that they and their employees pay the correct amounts of income tax and NIC following future terminations.