Starter Guide to Trade Marks for Fin-Tech Start-Ups

A crucial element to start-up success is creating brand recognition and brand value. In order to ensure that you have the best chance of doing so, it is important to consider IP strategy early on. Registering your brand name as a trade mark helps to prevent copycats from diluting your reputation, and allows you to commercially exploit your brand. Still not convinced as to why it is important? Here are our top three reasons start-ups in the fin-tech space should obtain trade mark protection.

- Avoids costly rebranding after the launch

Conducting trade mark clearance searches before filing, and obtaining trade mark protection early on in your plans, prevents, as best as possible, the need for expensive rebrands later down the line if infringement proceedings are brought against you by established competitors or earlier right holders. Due to the success of many fin-tech and crypto-currency businesses, well-established companies in this space are likely to have the means to bring infringement proceedings against new companies who they believe are infringing their rights. This can delay launch dates, or mean rebranding.

How to avoid this: We would strongly recommend carrying out clearance searches to ensure your brand name does not infringe any existing trade mark rights. These checks can include common law searches for earlier unregistered right holders, as well as registered domain names, social media accounts, and registered designs; all of which can be extremely important. Although doing these searches does come at an initial cost, it is worth it to avoid trade mark opposition or infringement proceedings later down the line, particularly if these come at a crucial point for growing your business.

- Safeguards against copycats

Owning a registered trade mark means that, if enforced, you can prevent copycats from using your brand. This is particularly important to avoid brand dilution and to make sure that consumers build up trust in the services you provide under your brand. It would be very damaging for your reputation if a copycat account was providing unregulated services on social media under your brand name, as consumers may think this account is associated with you.

For example, in 2017, Litecoin Foundation Ltd ('LFL') - the organisation incorporated to promote and develop Litecoin cryptocurrency – became aware that a third party had filed a trade mark application for LITECOIN covering financial services and virtual currency services. LFL tried to reach an agreement with the third party but was unsuccessful in doing so. LFL did not own any prior trade mark rights, so applied to register the LITECOIN brand at this point. Its application was opposed by another third party, who shortly after opposing the application, changed its name to Litecoin Exchange Ltd. Whilst a judge did find that the third party application for LITECOIN was an attempt to misrepresent to consumers an association with LFL, this case underlines the importance of registering trade marks early on to make sure you can take action against malicious third parties. Otherwise, as this case shows, the effects can be expensive and lengthy proceedings against a number of copycat brands.

The fin-tech market is highly competitive and fast-paced, particularly given that so many brands now use social media as part of their marketing strategy. So, it’s key to ensure you are taking proactive steps to build brand recognition and enforce your rights against others.

How to stop infringers: Once your trade mark has been registered, we can set up watching services to keep an eye on applications for trade marks that are similar to yours and in similar fields. We can also have watching services set up for domain names and monitor online content generally. This means we can prevent third parties from infringing your rights, which will lead to a strong brand reputation. If we identify any infringing use of your brand on social media, or perhaps on online retail platforms, we can submit takedown requests and/or send the infringing account a letter setting out your rights. You can then focus on building your brand and growing the services you provide, whilst we ensure your IP rights are protected.

- Gives your company a commercial advantage

Trade marks are a valuable property asset that are relatively cheap to obtain and maintain. They can also add significant value to your business. Once a reputation is built up in the brand, they can be licenced out to third parties, providing income for the company. They can be sold, purchased and assigned in their own right, without affecting the ownership of the company.

Investors will often look to see that IP ownership has been handled correctly, as they are likely to be less willing to invest in a start-up that is embroiled in a trade mark infringement dispute. Further down the line, if and when you decide to sell your fin-tech business, it will be important to show that the brand name(s) are protected by registered trade marks. It means buying the business comes with less risk for the purchaser, and shows they can exploit the brand with less risk of third parties bringing infringement proceedings against them.

How to commercialise your IP: We can ensure that your IP ownership is clearly defined and managed to allow you to exploit your brand. We can also give you suggestions of how to better exploit your IP, whether that be by registering your logo as a trade mark, or taking enforcement action against a similar brand.

Classes of protection

When registering your brand as a trade mark, you will need to consider what goods and services you obtain protection for. Amongst others, trade marks in the Fin-tech space are typically registered in the following classes:

- Class 9: This class protects the brand being used for software, which is essential for fintech start-ups, and mobile applications.

- Class 36: This class protects the brand being used for technology and financial services. It also covers banking, financial and insurance services.

- Class 38: This class protects the brand being used for communications services, such as a platform or portal for consumers.

- Class 42: This class protects the brand being used for SaaS platforms, or digital subscription content for customers.

However, each application has to be considered on an individual basis. It depends what will be offered under the brand, both at the time of filing and in future, as to which classes protection is sought under.

Summary

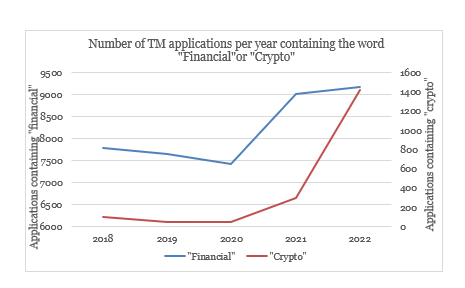

It is clear that trade mark applications for goods and services in the fin-tech space are on the rise. As shown in the graphs below, the number of trade mark applications in the EU filed for “crypto” related services increased from 303 in 2021 to 1,419 in 2022. Similarly, the number of trade mark applications containing the word “financial” increased from 7,791 in 2018 to 9,168 in 2022. We are also seeing similar developments in UK trade mark applications and US trade mark filings.

In this crowded marketplace, it is vital to ensure a strong brand management strategy is taken early on in the start-up process, as this will avoid unnecessary costs and delays later down the line.

How we can help

If you are a start-up, or an established company in the fintech space, and have any questions about what intellectual property rights you own and how they are valued, please do contact us. We would be delighted to hear from you.